This article (https://hbr.org/2018/06/why-we-need-to-update-financial-reporting-for-the-digital-era) touches on many heartbreaking perceptions & on some interesting trends:

– Accounting getting further from value-added with examples noted of CFOs avoiding inviting company accountants to their strategy meetings, considering CPA certification (US) a disqualification for top finance positions, & looking at resources spent on audits and financial reporting to be a waste of shareholder money

– Investors are paying more attention to ideas and options than to earnings, traditional valuations are not sufficient for digital era and there is increasing reliance on non-GAAP measures.

– “CFOs realize the growing limitations of the current financial reporting model. They are, however, extremely pessimistic about whether the model can be fixed within the current regulatory regime.”

With the effort, time and professionalism that is put forward in the external reporting and accounting areas of Finance it is a shame that the results and disclosure are so far from meeting the mark. The pressures on those teams and those assisting with compliance is increasing which is making this gap even more concerning.

Add to all of this we have the new accounting standards that arguably bring accounting further away from investors’ perspective. We may not be helping our own case.

Much of my career had been in this area of focus. The opportunity to report key performance indicators and results was always invigorating to me. I hope that this cycle takes a turn and we can find a way for the reporting to be useful and the regulations to allow us to add value.

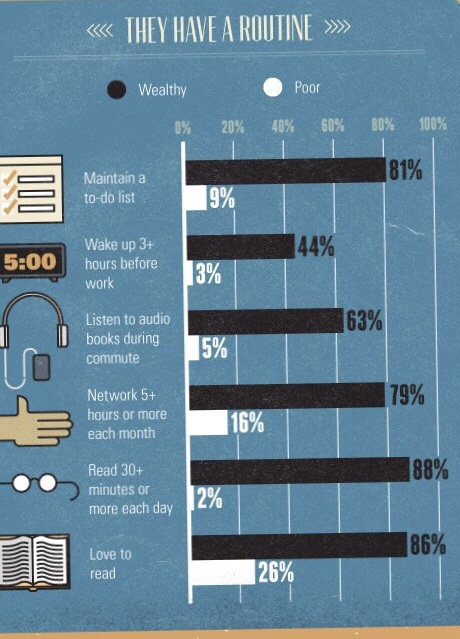

Business partnering, process efficiency, automation & other modernization can kick-start a Finance team on closing this gap.

Related reads:

https://www2.deloitte.com/ca/en/pages/audit/articles/corporate-reportings.html#